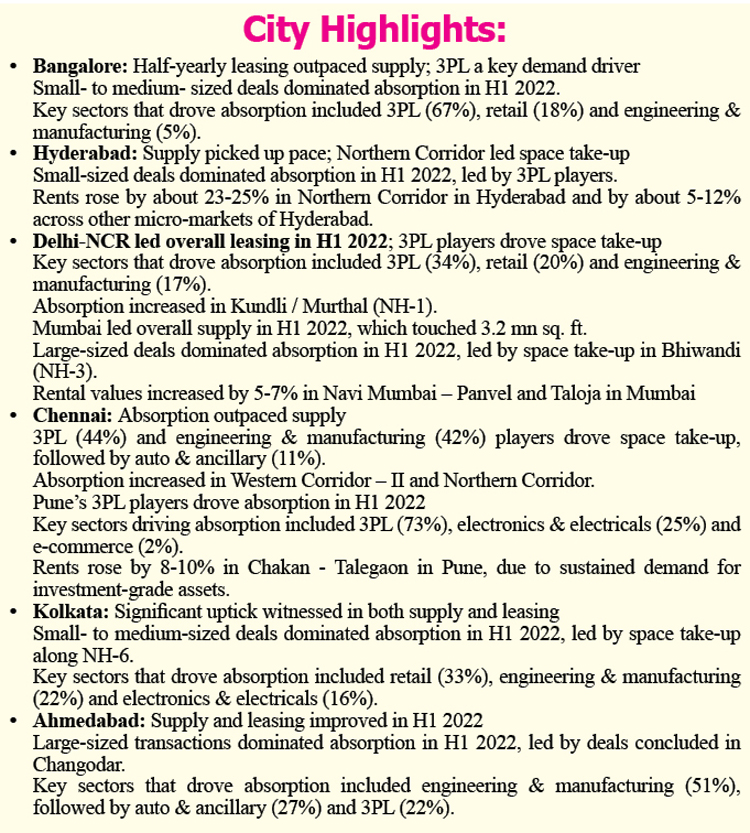

The report findings revealed that the I&L sector leasing in India stood at 12.8 million sq. ft., recording a dip of about 9% Y-o-Y during the first half of 2022. The space take-up was down by 17% on a half-yearly basis, compared to 15 million sq. ft. recorded in H2 2021, due to a slowdown in supply addition. However, the report highlighted that leasing activity would improve as continued land acquisition and development completions are lined up in H2 2022. Delhi-NCR, Mumbai, and Bangalore dominated leasing activity; these cities accounted for more than half of the overall space take-up. During H1 2022, 3PL players continued to drive the leasing activity with a share of 46% in the overall transaction activity, registering an increase of 10% Y-o-Y. Demand from stakeholders across the supply chain, including wholesalers, retailers and e-commerce players on account of holding forthcoming higher safety-stock, led to increased leasing activity by 3PL players. Other major leaders of leasing activity were occupiers from engineering & manufacturing (17%, up by 6%), followed by retail (13%), and e-commerce (6%). During H1 2022, supply addition decreased by about 32%, compared to 15 million sq. ft of project completions in H2 2021. Mumbai topped the supply addition, followed by Kolkata, together accounting for about half of the project completions.

The report pointed out that the share of medium-sized (50,000 – 100,000 sq. ft.) and large-sized (more than 100,000 sq. ft.) transactions increased on a half-yearly basis by 3% and 7% respectively. However, the share of small-sized transactions (less than 50,000 sq. ft.) declined to 36% as compared to 47% in H2 2021. Delhi-NCR and Mumbai dominated large-sized deal closures. These cities together accounted for about 41% of large-sized deals. From a sectoral perspective, 3PL followed by engineering & manufacturing companies drove large-sized deal closures with a total share of more than 60%. Further, led by sustained demand for investment-grade assets, rental values increased in select micro-markets of Hyderabad, Ahmedabad, Bangalore, Pune, Mumbai and Delhi-NCR during H1 2022. Instances of key investments in the I&L sector during H1 2022 included Ascendas India Trust’s investment of about USD 28 million in Arshiya Group’s asset in Mumbai, and another USD 28 million in Casagrand’s asset in Chennai. Overall, the I&L sector attracted about USD 144 million across greenfield and brownfield assets from global and domestic players during H1 2022.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said, “While global supply chain pressures are easing, we anticipate occupiers to continue to follow ‘just-in-case’ strategies alongside ‘just-in-time’ ones to maintain agility. Increased focus on upgradation / expansion opportunities in tier I cities; new market penetration in lower tier cities and extension of local distribution networks in emerging logistics hubs are expected to drive leasing in the future.” Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “Focus on operational efficiencies could lead to growth in ‘flight-to-quality’ leasing. In line with the demand, we anticipate development completions by organized players to increase in the coming quarters. Investment activity is expected to continue from global and local players, with both greenfield and brownfield acquisitions remaining attractive.”

Outlook & Trends – 2022

Leasing sentiments to remain positive: Overall leasing in 2022 expected to touch 28-32 million sq. ft., with a growth of up to 12% Y-o-Y. Space take-up would be led by continued expansion of 3PL, e-commerce, engineering & manufacturing, retail and FMCG firms. Delhi-NCR, Bangalore, Mumbai and Chennai would continue to drive transaction activity, while markets including Ahmedabad, Kolkata and Pune are expected to witness increased momentum of leasing activity. Supply addition to pick up pace: As supply chain bottlenecks have started to ease, project completions are expected to improve in H2 2022. Overall, about 25-28 million sq. ft. of new warehouses are estimated to become operational in 2022, registering a growth of up to 12% Y-o-Y. Supply addition is expected to be dominated by Mumbai, Delhi-NCR, Chennai and Bangalore. Moving closer to key nodes: Occupiers are likely to continue to lease more space to cut down on transportation costs. E-commerce and 3PL players would thus prefer to take up space closer to consumer hubs. Moreover, 3PL occupiers dealing with cargo handling would focus on securing warehouses closer to key transportation nodes. Similarly, engineering and manufacturing players are likely to prefer warehouses in proximity to industrial hubs.

Labour-saving building technologies to rise: Occupiers and developers are likely to adopt a broad range of advancement automations with the support of Big Data analytics, sensors and Internet of Things (IoT)-powered technologies to reduce labour dependencies. New-age supply to accommodate vertical storage: Warehousing facilities with features such as high ceilings to accommodate automated stacking systems, sufficient loading / unloading zones and power back-up provisions are likely to gain more traction. Rental growth to continue: Sustained growth in rentals across the cities is expected, owing to increased space take-up and addition of investment-grade supply. Rental growth in key micro-markets across cities would continue in H2 2022, especially, in investment-grade, tech-enabled and strategically located assets.