The Sensex as well as the Nifty50 fell by over 1% on March 18, 2020 amidst a spike in US bond yields. Among the sectors, the IT index fell by 3%, while pharma by 2%. The market opened in the positive after the Fed signalled continuation of the low rates regime. However, it failed to hold on to the levels on account of larger macro-economic concerns.

Direction – Trends can move in three directions—up, down, and sideways. If you study prices over a long period of time, you will be able to see all three types of trends on the same chart. Watch the slope – The slope of a trend indicates how much the price should move each day. The most common way to identify trends is using trendlines, which connect a series of highs or lows. Uptrend: If you can connect a series of chart low points sloping upward, you have an uptrend. An uptrend is always characterized by higher highs and higher lows. Rotation in the stock market refers to switching from one set of stocks to the other. The thinking in the stock market is that usually a particular set of stocks move together. … Stock rotation could be from growth to value, defensive to cyclical, or large-cap to small-cap, and vice versa.

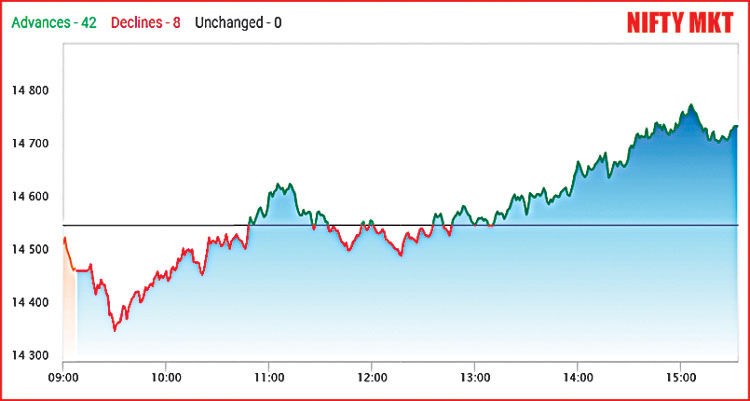

In the last one week, the Sensex has declined by 4%. In the last one month, the Sensex performance depicted below shows that the markets have been in a seesaw mode. So what are the factors that have been driving the markets and will determine its direction from here on.

High inflation: Retail inflation (CPI) soared to a three month high of 5.03% in February 2021, from a 16 month low in January, on account of costlier food items and higher fuel prices. WPI inflation was also up 2% from January levels at 4.17%. According to a CARE Ratings report, “Price pressures are likely to prevail in the coming months given the rise in global prices across commodities and the rise in food prices. The rise in inflation could come in the way of economic recovery and can pose a challenge to the RBI in maintaining an accommodative policy stance.”

The Reserve Bank of India has supported maintaining the existing inflation target of 4% within a band of 2 percentage points. A rise in inflation could lead to a reversal in interest rate cuts and make investments in equity markets unattractive.

Rising crude oil prices: Crude oil prices have been on a boil in recent weeks. After rising to $71 per barrel last week, Brent crude has been hovering in the range of $65 to $70 per barrel amid output cuts by majors and optimism about global economic recovery amidst reopening and vaccinating of population. Prices have increased by 75% since November 2020. India is a major importer of crude oil and the rise in prices adversely our import bill. Oil is required to meet domestic fuel needs and it is a necessary raw material used in a number of industries. An increase in the price of crude oil results in high inflation, increasing the cost of producing goods and thus reducing the profitability.

Return of COVID-19 fears: COVID-19 cases are rising in India led by Maharashtra which is one of the most industrious states in India. India recorded 35,871 new COVID-19 cases, the highest single-day rise in 102 days. Night curfews are back in many parts of the country. Mumbai, the financial capital of the country, is staring at another lockdown. Any fresh lockdown could be disastrous for the Indian economy which has just started to recover from the pandemic blues registering a GDP growth of 0.4% in Q3 FY 2020-21.

The vaccination drive has been rather slow with only 3 crore inoculated in two months. The latest concern around the AstraZeneca vaccine and many countries suspending its use could pose risks.

Rising bond yields: A steep rise in US 10-year bond yields has triggered a global selloff in equities. The yields rose by more than 5% to 1.73. In the last three months, the yield has increased by 83%. The spike in bond yields does not bode well for emerging markets like India. A rise in bond yield increases the differential between India’s earning yield and US bond yields which impacts FII flows. Many funds are either holding back or pulling back their investments leading to a selloff in Indian markets.

Declining IIP: India’s industrial output, measured by the Index of Industrial Production (IIP), contracted 1.6% year-on-year in January, 2021. Mining and manufacturing output declined 3.7% and 2%. IP declined for five consecutive months from April to August in FY 20-21 amidst the lockdown before returning to positive territory in September. Its return to negative territory in January 2021 is a cause for worry.

To sum up, many experts are warning that a share market correction is in the making. The complex interplay amongst the factors listed above along with movement in dollar against the rupee and performance of global stock markets would determine the direction of the markets from here on.