If India Auto Inc is seeing a glimmer of hope in terms of sustained growth, it has the two-wheeler and passenger vehicle segments to thank. From the March 2021 and FY2021 sales numbers released by the top four two-wheeler OEMs, it is amply clear that in the second half of the year, they have managed to claw back a substantial amount of sales lost in the troublesome first half.

However, given that these four players are also the key drivers of mass mobility in the form of entry-level motorcycles and scooters, it can be surmised that Covid-induced loss of sales from consumers belonging to the bottom of the pyramid would have contributed significantly to the dampened sales. Effectively, it’s been only 11 months of sales in this financial year.

Renewed surge of Covid-19 infection across the country is fanning fear about further halt in production even as the segment is tackling challenges like production slowdown due to supply-chain shortage, sky-high fuel prices and concerns about customers’ buying power.

Hero MotoCorp: 57,91,539/ -9.6 percent

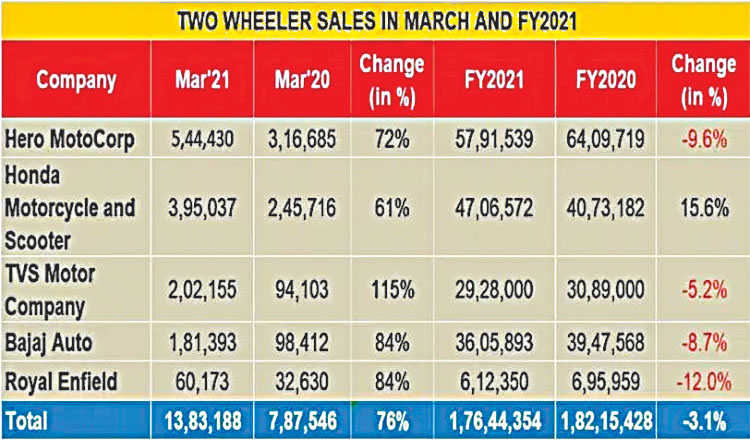

The world’s largest two-wheeler manufacturer, Hero MotoCorp sold around 5,44,430 units of motorcycles and scooters in March, 2021. This is a growth of 72 percent over March 2020 when they sold 3,16,685 vehicles. The two-wheeler maker clocked a 19 percent growth on the MoM basis compared to February 2021 when around 4,84,433 units were sold. Bikes like Splendor, Passion, Xpulse and scooters including Maestro and Hero Destini continue to be the best sellers for the two-wheeler maker. Interestingly Splendor and Hero HF continue their winning streak right from the beginning of 2021 – both these bikes were the top selling bikes in India in January as well.

Hero also registered its highest-ever sales in global business in a single month by clocking 32,617 units in March, nearly an 82 percent increase. However, if we compare the performance in the entire fiscal, Hero MotoCorp sold 57,91,539 two-wheelers in FY2021, down 9.6 percent compared to the previous one (FY2020: 64,09,719 units). The company said the sales were adversely impacted last year due to the transition to BS VI from April 2020, in addition to the nationwide lockdown last year to contain the spread of Covid-19.

Interestingly, Hero MotoCorp had already announced a hike in prices of its scooters and motorcycles with effect from April 1, 2021 to partially offset the impact of increased commodity costs. The price increase across the range of two-wheelers will be up to Rs 2,500.

HMSI: 47,06,572/15.6 percent

Continuing a positive sales growth momentum, Honda Motorcycle & Scooter India sold 3,95,037 units in March 2021, up 61 percent year-on-year (March 2020 sales: 2,45,716 units). However, the month-on-month performance has not been encouraging, with sales dropped four percent compared to the 4,11,578 two-wheelers sold in February 2021. Bucking the industry trend, Honda closed FY2021 with a total sale of 47,06,572 units, up 15.6 percent from the 40,73,182 units in FY2020. The company also exported 16,000 vehicles in March 2021. Honda CB Shine, H’ness 350 and Dio are some of the top selling motorcycle and scooter models for the company.

Yadvinder Singh Guleria, Director – Sales & Marketing, Honda Motorcycle & Scooter India said, “FY2021 was a year of unprecedented uncertainties. India became the epicentre of Honda’s two global unveilings (H’ness CB 350, CB350 RS) and followed this with the scintillating Indian debut of CB500X & CB 650R.” The company is concentrating on the premium bike segment in India and has also expanded the BigWing touch points across the country. It is also targeting the young motorcycle enthusiasts in the country with launches like the Honda CB650R and Honda CBR650R.

TVS Motor Co: 29,28,000/-5.2 percent

TVS Motor Company’s domestic two-wheeler sales grew by a staggering 115 percent in March 2021 at 202,155 units led by Apache, Ntorq, Jupiter, Star City compared to 94,103 vehicles sold in March 2020. Even on a month-on-month basis, the Chennai-based manufacturers posted a four percent growth in comparison to the 1,95,145 units sold in February 2021. For the entire financial year, the performance was still below previous highs. The overall FY2021 sales slipped 5.2 percent to 29,28,000 units compared to 30,89,000 two-wheelers sold in FY2020.

Motorcycle sales grew by 136 percent year-on-year at 1,57,294 units this month (March 2020: 66,673 units). Scooter sales grew by 206 percent year-on-year at 1,04,513 units (March 2020 sales: 34,191 units). The company’s total two-wheeler exports grew by 164 percent at 1,05,282 units in March (March 2020 exports: 39,885 units). This is primarily on the back of increase in motorcycle sales in key international markets.

Commenting on the higher exports, Sudarshan Venu, Joint Managing Director, TVS Motor said, “Our international two-wheeler business achieved a sales milestone of 1,00,000 units in March. Along with our industry peers, we look forward to continuing playing a role in making Indian two and three-wheelers popular and aspirational in many global markets.”

Bajaj Auto: 36,05,893/-8.7 percent

Bajaj Auto’s March sales jumped 84 percent to 1,81,393 units as against 98,412 units in March 2020 with the Pulsar and Dominor emerging as the best sellers for the bike maker. For the overall financial year, the company’s sales are down 8.7 percent to 36,05,893 units compared to 39,47,568 units sold in FY2020.

Exports increased 32 percent to 1,48,740 units from 1,12,564 vehicles sold in March 2020. According to Rajiv Bajaj (as discussed in an interview with Autocar Professional in March), “As far as exports are concerned, it’s so far so good but we should still wait and watch. We have to see how things evolve. We must remember that for the first three months, we could not export anything and we are seeing some of that pent-up demand also to that extent 2,50,000 units a month is not the new normal and I would say that it is still 2,00,000 units only.” Even compared to 1,48,934 two-wheelers sold in February 2021, March sales grew 22 percent.

Royal Enfield: 6,12,350/-12 percent

Royal Enfield’s March sales grew 84 percent to 60,173 units compared to 32,630 units during the same month last year. However, compared to 65,114 bikes sold in February, the March sales dropped eight percent month-on-month. It is interesting to note that the 2021 Autocar India Bike of the Year, Meteor 350 was among the best sellers along with the Classic 350. The company exported 5,885 units in March 2021. This is particularly striking given the company’s focus on growing the export share. In fact, the midsize motorcycle major also opened its first flagship store in Tokyo in January in line with Royal Enfield’s focused international thrust of leading and expanding the global mid-sized motorcycle segment (250-750cc).

For the entire financial year, FY2021, Royal Enfield sold 6,12,350 motorcycles down 12 percent from 6,95,959 units sold in FY2020. The company recently announced the launch of new colours on the 650 Twin motorcycles in an effort to strengthen its hold in the mid-size motorcycle (250cc-750cc) segment.

So overall, the headwinds continue for the two-wheeler manufacturers with commodity prices still hovering at the higher end of the spectrum and shortage in semiconductor chips. As Bajaj Auto MD, Rajiv Bajaj highlighted in a recent interview with Autocar Professional in March, 2021, “Costs have gone up and everybody has increased prices. Now there is talk of increasing them further from April 1 or thereabouts. It is one of the highest spikes in commodities in recent times.” In some states like Maharashtra, a key auto hub, the bulk of oxygen supply has been redirected primarily for medical purposes, given the resurgence in Covid-19 cases. This along with the other challenges make the road to revival a rather bumpy one.