Indias millennials are spending more responsibly; borrowed most for home repair & medical emergencies

The spending patterns of millennials are shifting. The millennial generation, known for borrowing for their lifestyle needs and spending recklessly, is now taking a personal loan to tend to more serious priorities. According to new data from SimplyCash, the instant loan app powered by the Hero Group, spending on travel and other expensive purchases have now taken a backseat, with millennials spending more on home improvement and health.

Who are millennials?

Millennials, also known as Gen Y, are defined as adults aged between 22 and 38 years as of 2019. As per Morgan Stanley Research, there are 400 million of them in India, accounting for one third of the country’s population and 46% of the workforce. With the youngest millennial turning 24 this year, they have become the key drivers of consumer markets. Therefore, it has become important to understand this generation’s spending and borrowing trends. Most millennials have now graduated from college and are at a point where shouldering responsibilities has become a part of their lives. Paying bills, filing taxes, student loans, are obligations that are urging them to be more responsible with their finances. Some millennials are also parents to young children. This means having to bear expenses that come with raising a child among others.

Shifting trends in the spending pattern of millennials:

What are the millennials borrowing for now?

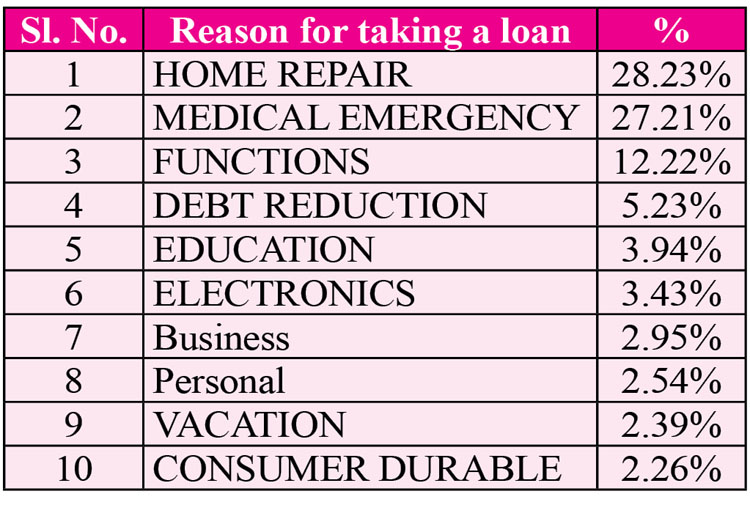

In the last 6 months, SimplyCash says, 28% of instant personal loans taken from them by millennials were taken to fund ‘home repairs’. Following closely, 27% of the loans were taken for medical emergencies, while 12% were taken for ‘family functions’. While ‘paying off debts’ accounted for 5% of the loans, ‘funding education expenses’ accounted for 3%. Reasons like personal need, vacations and consumer durables featured at the bottom of the list at 2% each. This shows that the borrowing intent and spending pattern of India’s millennials are not just recreational these days, but more responsibility driven. The loan activity on SimplyCash reveals spending trends by analysing the borrower’s behaviour patterns. A growing sense of responsible spending among Indian millennials is now the biggest driver of increasing instant loan applications.

The top five reasons for taking a personal loan indicate a sort of coming of age for Gen Y. It confirms that while they haven’t stopped borrowing for recreational purposes, it is definitely not a priority now.

“We are seeing the millennial population of India availing personal loans in large numbers. And a majority of them are availing the loans for fulfilment of financial needs. We are happy to serve them, and hope to be their financial partners in the future as well,” said Prashant Chopra, National Manager – Digital, Hero FinCorp. In order to help people during the pandemic with their instant cash requirements, SimplyCash has expanded its operations to 68 more cities. Now, time-conscious millennials across 90 cities in India can download the SimplyCash app from Google Playstore, Xiaomi Store, Samsung Store, and quickly avail cash loans as per their need. Simply Cash is rapidly being recognized as a trusted platform where people can get instant loans with no hassle of physical documentation and with super quick service.

Brand perception: Safety first

As instant cash loan apps become the preferred mode of availing loans for young India, the need for choosing the right lending platform also becomes critical in terms of security and safety. Last month alone, Google removed over 450 personal loan apps that violated safety and other policies on Play Store. The Reserve Bank of India has also taken note and announced it would set up a group to understand this growing trend and suggest framework for its growth and regulation. This is where SimplyCash has emerged as one of the most bankable credit provider. Being a part of the Hero FinCorp, a brand known for its legacy of trust, this instant loan platform has been earning the trust and loyalty of millennials by ensuring data security and safe transaction processes.

Driven by technology and fuelled by innovation, this app makes the process of lending even more accessible, quicker, easier, and more secure. The platform reflects Hero FinCorp’s overarching philosophy of partnering with every Indian and offering immediate financial support in times of their need.