■ Technology enables SimplyCash to extend support where needed;

Disburses loans worth Rs.200 cr in 10 months

The personal loan market is not following a downward trend; its just following a different trend

New Delhi, Aug. 4 (FN Agency) Instant personal loan app SimplyCash, which shattered the myth of a downward-trending personal loan market by disbursing instant personal loans worth Rs.200 crores between August 2020 and May 2021, says most of its consumers opted for instant personal loans through its platform because it was easy to use, convenient and offered quick loan disbursal.

Consumers prefer quick disbursal of loans, easy-to-use ways to avail loans

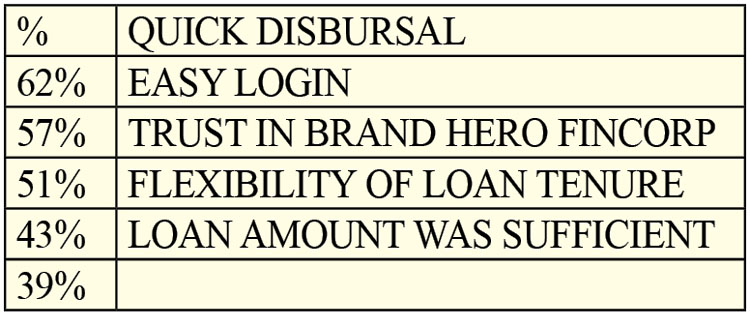

With the COVID-19 situation, more and more consumers, especially millennials, prefer applying for and availing loans through contact-less, instant personal loan platforms. Instant personal loan apps like SimplyCash offers them just that – hassle-free and instant application process and quick disbursal of loan. According to a survey conducted by SimplyCash, 62% of the respondents chose the platform as it offers quick loan disbursal. Meanwhile, 57% found the SimplyCash platform convenient, user-friendly and easily accessible. Trust in the Hero Fincorp brand also played a role in choosing the SimplyCash app for instant loans, according to 51% of the respondents. This proves that while customers want convenience, brand trust was still important for them while availing loans.

Top Reasons Why Customers Chose SimplyCash Instant Personal Loan

The survey also showed that people preferred Simply Cash’s mobile app because it offered them benefits that were not available at traditional platforms. They liked how the app explained to them easily how to avail a loan, without even stepping out to meet a customer executive at a bank, and how to repay easily. No documentation, self-explanatory screens, and satisfactory customer service was also cited as reasons by respondents on why they chose Simply Cash. Because of this ease of technology, Simply Cash was able to tap clusters of credit deserving people. “There are various clusters of credit-deserving people who do not have access to quick credit, due to requirements of extensive documentation or personal interactions by traditional lending institutions. SimplyCash solves this through technology and is focused on reaching out to credit-deserving Indians who are unserved or underserved,” says Prashant Chopra, National Manager, Digital, Hero FinCorp.

About SimplyCash

Powered by Hero FinCorp, SimplyCash is an instant personal loan app that provides cash loans of up to Rs.1,50,000 for both salaried and self-employed individuals. Driven by technology and fuelled by innovation, SimplyCash mobile app is available on Android play stores such as Google Play Store, Samsung store, Xiaomi store, etc. With a widespread presence, SimplyCash currently offers its services in over 90 major locations in India. It is a duly registered trademark and is a loan product offered, managed and operated by Hero FinCorp.

About Hero FinCorp

Finance Made Easy. Three simple words that drive India’s next-generation ultra-lean credit champion-Hero FinCorp Limited. It was incorporated in December 1991 as Hero Honda FinLease Limited. As of March 2021, Hero FinCorp, at a consolidated level, has reached assets under management of Rs. 27,464 crore.