Goldiam International Ltd. (Goldiam), an integrated manufacturer and supplier of impeccable diamond jewellery to leading retailers and wholesalers in the USA and Europe, has announced its results for the quarter ended on 30th June 2021. The Company reported its highest ever first quarter sales in Q1FY22. The Company’s YoY is not directly comparable because of the plant shut down last year on account of Covid-19 related lockdowns. However, shunning that effect, YoY performance is quite robust. Both Revenue and Margins have witnessed strong momentum on account of demand uptick in its Lab Grown Diamond (LGD) Jewellery and Natural Diamond Jewellery.

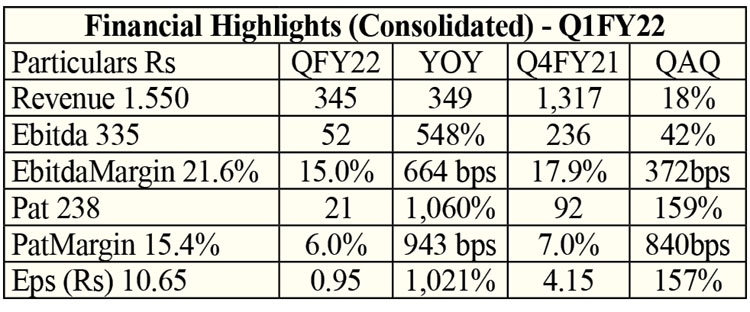

Consolidated Revenue for the quarter was up by 349% YoY to INR 1,550 million due to a strong uptick in US Jewellery demand from Retailers & End Customers. Enhanced demand profile with the reopening in the US, leading to a robust sales pipeline in Q1FY22. Consolidated EBITDA for Q1FY22 surged by 548% YoY to INR 335 million, EBITDA margins expanded by 664 bps YoY to 21.6% during the quarter led by operating leverage and better product mix. The Company’s strategy of selling Lab grown Diamond jewellery backed by captive lab grown diamonds have resulted in better margin profile over the year. Moreover, omnichannel sales strategy too has resulted into better efficiency in Q1FY22 leading to the overall improvement in margin profile. Consolidated PAT for Q1FY22 registered an exponential growth of 10.6x YoY to INR 238 million driven by overall business efficiency.

Update on Lab grown Diamonds/Jewellery

Currently, LGD jewellery constitutes 15% of overall Revenue and has been witnessing strong growth momentum. On the LGD front, the Company has reached the highest realization per diamond grown due to enhanced technologies. The Company has been focussing on large caratage diamonds which yields better realisations and in turn higher margins as well. The Company owns 88% stake in Eco-Friendly Diamonds LLP (EDL) which is involved in the manufacturing of Lab Grown Diamonds. Update on Buy Back/ Dividend: Company has a Dividend distribution policy of distributing minimum 50% of standalone profits. The Company has proposed a buyback up to 6,65,248 equity shares of the Company on 21st July 2021 for an aggregate amount not exceeding INR 449.0 mn. The maximum buyback price is set at INR 675/- per equity share as on the record date on a proportionate basis under the tender offer route using the stock exchange mechanism. The buyback size constitutes 3.0% of the total paid-up equity share capital and ~19.1% of the total standalone paid-up equity share capital and free reserves of Goldiam as on FY21. Over the last five years, Goldiam has carried out two buybacks of shares to the tune of INR 300 mn. During the last five years (FY17-21), Goldiam has utilized INR 841.7 mn on Dividends and Buybacks.

Cash & Cash Equivalent and Investments

The Company’s Cash & Cash Equivalent and Investments stood at INR 3,000 mn as on Q1FY22. The Company would continue to explore various opportunities to judiciously utilise the cash reserves.

Order Book Status

The company has an order book size of INR 2,600 mn, of which lab-grown diamonds constitute 10%. This order book is expected to be executed over the next 5 months. The Company has been operating at an all time high order book. E-commerce sales given its nature of being booked online (on spot basis) is not part of the order book. It constitutes c.20% of overall Revenue. Commenting on the performance, Mr. Rashesh Bhansali, Chairman and Managing Director, Goldiam International, said, “Goldiam has started the new fiscal on a high note. The Company has registered the highest ever first quarterly sales & margin profile thanks to a robust uptick in US Jewellery demand from Retailers and End Customers, particularly in the categories which are core strengths of the Company. Goldiam’s backward-integration in lab-grown diamonds coupled with prudent business strategies and numerous digital initiatives has started to yield rich dividends. Goldiam has achieved the highest realization per diamond in lab-grown diamonds owing to its state-of-the-art technology. Along with performance, company’s balance sheet remains strong, with cash & cash equivalent & investments. Our endeavour remains to be in high margin business and keep our balance sheet strong which shall continue to reap beenfit over longer period of time”

About Goldiam International Ltd.

Goldiam International Limited (NSE: GOLDIAM, BSE: 526729) is a 3-decade old exporter of exquisitely designed and luxurious diamond jewellery. Functioning as the manufacturer of choice to many of the leading global branded retailers, departmental stores and wholesalers across American and European markets, the Company is also renowned for utilizing responsibly sourced diamonds, leveraging cutting edge technologies and efficient manufacturing processes for optimal costings and short delivery lead-times. Targeting the mid-to-affordable diamond & bridal jewellery segments, Goldiam has a dedicated sales office in New York, with design teams in both India and the USA.