The Australian Bureau of Statistics (ABS) records show an all-time high of 78,000 jobs in the sector – the highest recorded since 2013. This comes in the wake of the proposed Adani Coal Project in Queensland which is touted to bring in more jobs.

The Australian mining industry is on a high even as other sectors find themselves stuck in the pandemic quagmire. It has become a symbol of resilience and stability amid the economic slowdown that followed COVID-19. Figures from the Australian Bureau of Statistics (ABS) reveal that mining was responsible for more than a tenth of the economy in 2019-20, contributing to exports worth $221.2 billion.

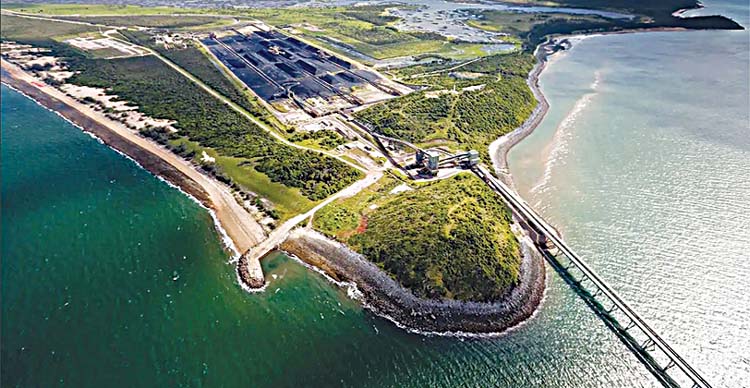

While other industries were forced to shut down, the mining sector held fast. The Newcrest gold mines of New South Wales, under construction Adani CoalProject in Queensland and the BHP iron quarries in Western Australia have continued to operate throughout the period and help arrest the economy’s free-fall. An astounding fact is that mining occupies the largest slice of Australia’s national GDP. ABS reports showed that the sector contributed to as much as 10.4% of the 2019-20 GDP.

This strong performance meant that mining was just one of the four sectors to contribute positively, namely public administration, safety and education and training and financial services. In the period between June 2019 and June 2020, construction works saw a 10.3% drop, administration 23.2% and administration and food services witnessed a 43.4% fall. In comparison, mining grew by 1.1%. With diversified business organizations such as the Adani Group firm on its commitment to the linked coal project, the country’s mining sector can expect even better prospects. Across the board, the Australian mining exports have grown exponentially – in quality and quantity as well. For instance, Australia toppled pandemic-struck Brazil and became a major exporter of iron ore, owing to the companies like BHP. If the current trend continues, the total value of its iron ore exports is expected to shoot up from $77.8 billion in 2019-20 to $93.8 billion in 2020-21. While production of certain minerals like gold dipped initially, as reported by mining giant Newcrest, it will certainly rise again, with global production slated to grow by 5.5% in 2021.

The stability and profitability shown by the mining industry have resulted in additional hires joining the workforce. This means that the total number of Australians employed in mining has seen an increase over the years. Official records show that the number of employees in the sector rose by a whopping 21.4% between 2015 and 2020 to round off at 261,900. Data collected in the recent months showed a continuing growth across Australia, with Queensland displaying a 40% rise in coal-related jobs. The Australian Bureau of Statistics (ABS) records show an all-time high of 78,000 jobs in the sector – the highest recorded since 2013. This comes in the wake of the proposed Adani Coal Project in Queensland which is touted to bring in more jobs. Despite facing resistance from environmentalists, Adani remains undeterred in delivering its promise to Queenslanders as well as other stakeholders through its project. David Boshoff, head of the Adani Coal Project, said, “Mining has cushioned the Queensland and Western Australian economies from the worst of the devastating economic impact of the Covid-19 lockdowns and we are proud to be a part of that.”

The Adani Coal Project has seen the inclusion of smaller, local contractors, which will ensure the project’s continuation. Boshoff also said that 88% of the Adani Carmichael mine contracts were being delivered in Queensland. This indicates the multiplier-effect of the project on the region’s future. Tania Constable, Chief Executive Officer of the Minerals Council of Australia, said, “The Australian minerals industry is a major contributor to investment, high-wage jobs, exports and government revenues in Australia.” Describing the industry as a “pillar of stability”, she further added, “To ensure mining continues to drive Australia’s post-COVID economic recovery, governments should support the industry with faster project approvals, competitive tax rates, co-investment in modern skills programs and more flexible workplaces.”

There is, however, a huge cost Australia has to bear in exchange for the gains the mining sector brings. Legitimate concerns over mining activities are growing and threatening to shut out the only sector that has arrested the free-falling Australian economy during the pandemic. If and when Australia puts a curb on mining activities, will there be another sector ready to shoulder the weight of its absence? Will the economies founded on the country’s exports return to ease its burdens? Sometimes, the questions are easy and the answers are complicated and Australia needs to find them, quick and fast.