? Q4 Disbursements Grew 51% Sequentially

? Accelerated Provisioning to minimise Future Volatility

Arman Financial Services Ltd (Arman), a Gujarat based non-banking financial company (NBFC), with interests in microfinance, two-wheelers, and micro-enterprise (MSME) loans, announced its financial results for the quarter and year ended 31st March 2021.

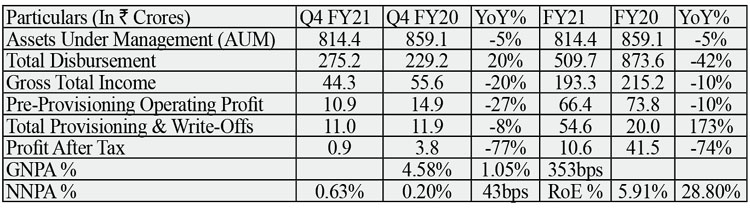

Consolidated Financial Highlights – Q4 FY2021

Assets under management as on 31st Mar’21 stood at Rs. 814 crores, lower by 5% YoY as higher repayment rates combined with lower disbursements led to a run-down in the loan book. Disbursements picked-up the pace across all segments from Oct’20 onwards. Loan Disbursements during Q4 FY21 stood at Rs. 275 crores, up 51% QoQ; the pace of disbursements is expected to reach pre-covid level as the second wave situations seems to normalize now. In Microfinance segment, the company had primarily focused on renewing loans of existing customers in the previous quarters. During Q4, the company started servicing new customers as well. Monthly disbursement reached a peak of Rs. 90 crores in March 2021 as a result of new branch openings and economic revovery post Covid 1.0 lockdowns. In the MSME & two-wheeler segments, the company continues to take a cautious approach while disbursing the fresh loans by increasing underwring and reducing ticket sizes. The MSME segment has reached average disbursements of pre-covid levels in March, while two-wheeler segment has yet to reach pre-covid levels.Shareholders Equity stood at Rs. 186.8 crores as on 31st Mar’21. Comfortable Leverage Position: Debt-Equity Ratio as on 31st Mar’21 was 3.9x Gross Total Income declined by 20% YoY to Rs. 44.3 crores on account of lower booking of processing fees due to lower disbursements and a decline in the portfolio. Similarly, Net Total Income decreased by 18% YoY to Rs. 25.1 crores. Finance cost came down by 23% YoY to Rs. 19.2 crores as the average borrowings reduced on YoY basis, combined with raising of debt funds at relatively lower rates from NABARD, SIDBI & MUDRA. Pre-Provisioning Operating Profit decreased by 27% YoY to Rs. 10.9 crores due to lower net total income as a result of a decline in the aveage portfolio. The cost-to-income ratio stood at 56.7% in Q4 FY21 versus 51.4% in Q4 FY20. Provisions & write-off (Impairment Losses) Cumulative Total Provisions and write-off (Impairment Loses on Financial Assets) for the year was Rs. 54.6 Crore as on 31st Mar’21, The total provisions on the books stood at Rs. 51.54 cr as on 31st March 2021. Given the higher provisioning, Profit after tax stood lower at Rs. 0.9 crores for 3 months ended and Rs. 10.6 crores for 12 months ended 31-Mar-21. Adjusted for the higher provisioning on account of the Covid-induced disruption, Profit after tax would have been substantially higher. Consolidated GNPA stood at 4.6%; NNPA stood at 0.6% for March 21. Total operational branches as on 31st Mar’21 stood at 239 (198 in MFI, 35 in MSME and 6 in 2W). The company opened 27 new branches during Q4 in the microfinance segment in anticipation of higher growth in the coming fiscal year 2022.

Update on Collections Efficiency

Collections continued to show sequential improvement since September 2020 to March 2021 across all segments. Collections were impacted due to Covid second wave in April and May 2021, which is now again coming back to normal with the easing of lockdown restrictions across geographies. Decline in repayment rate during April and May was primarily due to lack of access to the customers in many of the geographies with more stringent lockdowns. There is significant improvements in the MTD repayment figures during June 2021.

Update on Liquidity: Healthy Liquidity position with Rs. 132.06 crore in cash/bank balance, liquid investments, and undrawn CC limits

The company has duly repaid all the debt obligations that were due in Q4 FY21 and had accelerated the debt repayment for higher coupon debts in Q3FY21. Company’s liquidity position remains strong with Rs. 132.1 crore in cash/bank balance, liquid investments and undrawn CC limits. Our ALM continues to remain positive and we continue to have access to new sources of funds.

Going forward, Arman’s foremost priority will be to improve its collections from the field and restoring it to the pre-Covid levels. Further, the company will also be focusing on scaling-up disbursements in a calibrated manner and expects the pace of disbursements to pick-up in the forthcoming quarters.”

Segmental Performance Update – Q4 FY21 v/s. Q4 FY20

MFI AUM stood at Rs. 643 crores – marginally higher by 4% vis-à-vis last year Gross NPA % was higher at 4.13% in Q4 FY21. Post ECL adjustment, NNPA stood at 0.57%. Pre-provisioning Operating Profit decreased by 17% YoY to Rs. 7.8 Crore in Q4 FY21. Cumulative Total Provisions & write off for FY 21 was Rs. 36.7 crores. The total ECL Provisions as on 31-03-2021 were Rs. 33.11 crores covering 5.15% of the total AUM. Interest recognized on NPA assets ( 90+DPD) was 4.56 cr. There is a 100% provision on this not included in Rs. 33.11 Crore provisions mentioned above.

2W & MSME AUM stood at Rs. 171.3 crores in Q4 FY21 MSME AUM stood at Rs. 125.4 crores 2W AUM declined by 52% YoY to Rs. 45.9 crores, as the 2W sales declined in the last one year given the challenging economic environment. Further, lower disbursements during the year along with high repayment rates have led to a run down in the 2-wheeler book.In-line with the decline in AUM, Pre-Provisioning Operating Profit declined by 40% YoY to Rs. 3.5 crores. GNPA % and NNPA % stood at 6.6% and 0.87% respectively. Cumulative Total Provisions stood at Rs. 18.4 crores as on 31 Mar’21, covering 11% of the AUM. (Cumulative Total Provisions includes Cumulative Covid Provision of Rs. 12.7 crores as on 31 Mar21). Interest recognized on NPA assets ( 90+DPD) was Rs. 1.52 cr. There is a 100% provision on this not included in Rs. 18.4 crores above.

About Arman Financial Services

Arman Financial Services Ltd (NSE: ARMANFIN) (BSE: 531179) is a category ‘A’ Non-Banking Finance Company (NBFC) active in the 2-Wheeler, MSME, and Microfinance Lending business. The Microfinance division is operated through its wholly-owned subsidiary, Namra Finance Ltd, an NBFC-MFI. The group operates mostly in unorganized and underserviced segment of the economy and mostly serves niche rural markets in Gujarat, Madhya Pradesh, Uttar Pradesh, Maharashtra, Uttarakhand, Rajasthan, and Harayana through its network of 239 branches. Arman’s big differentiator from a Bank and other NBFCs is the last mile credit delivery system. They serve areas and clients where it is simply not possible for banks to provide financial services under the current market scenario.