In conclusion, different exchanges have different security measures in place. Even the most secure cryptocurrency exchange can be hacked, however, and it is important to research all crypto exchanges carefully before deciding where to store your digital assets. You should investigate the different types of cryptocurrency wallets and choose an exchange that provides a wallet that matches your security needs. The most important thing to remember is to be vigilant in protecting your cryptocurrencies from criminals who are always finding new ways to exploit digital assets and their owners.

As the demand for cryptocurrencies continues to rise, so does the need for exchange platforms that can safely store digital assets. Exchange hacks are on the rise, and experience has shown that it is important to be aware of how an exchange manages customer funds. There are currently hundreds of cryptocurrency exchanges available around the world. In this article, we will take a look at some of the security measures these exchanges employ to protect cryptocurrencies from hackers and other malicious actors.

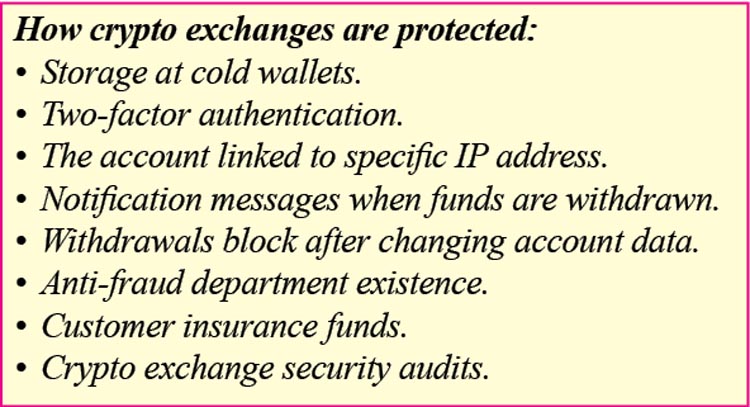

Each cryptocurrency exchange has a different approach to security, but there are a few measures that can apply to all exchanges:

Multiple-Factor Authentication (MFA): This requires customers to provide more than one form of ID when signing up for an account. This makes it more difficult for hackers to gain access to accounts.

Two-Factor Authentication (2FA): A 2FA process usually involves sending a code through telecom or email, making it more secure than MFA.

Email Verification: This is a measure to make sure the person logging in from a new IP address or from a new device is indeed who they say they are. Emails can be reset with verification codes, but this makes it difficult for hackers to gain access to an account.

Cold Storage: This involves storing cryptocurrencies in servers that are not connected to the internet. It makes it harder for hackers to get their hands on cryptocurrencies on bitcoin prime because of the layers of security they would need to pass through.

Multi-Signature: A multi-signature (multisig) wallet is a mechanism involving more than one key and where none of them alone is sufficient to release the funds. Together, they require multiple keys sign off on transactions before they can be completed.

Transparency: Cryptocurrency exchanges are often faced with allegations of fraud or mismanaged customer funds. This is because the lack of transparency has made it easy for these exchanges to cover up any fraudulent activities they are involved in. Transparency is important for customers to verify the exchanges’ honesty with their dealings. Many cryptocurrency exchanges are taking proactive steps to improve security features for digital asset storage.

How to Find a Secure Crypto Wallet

Before investing in any cryptocurrency, it is important to secure your funds. Cryptocurrency wallets are the most common way investors store their digital assets. There are different types of cryptocurrency wallets, but hot wallets are typically less secure because they are connected to the internet. They provide ease of use at the expense of security. Cold storage or hardware wallets are the opposite – they are not connected to the internet and offer robust security. Hot wallets can be broken into or hacked, especially if their encryption method is weak. It is important to research wallet providers thoroughly before investing in cryptocurrencies stored in hot wallets. You should consider using a cryptocurrency exchange that has proven its commitment to keeping customer funds safe through strong security features and transparent policies. Always remember to look for the best available customer support, as well as two-factor authentication. Your peace of mind is one of your greatest assets in this space.