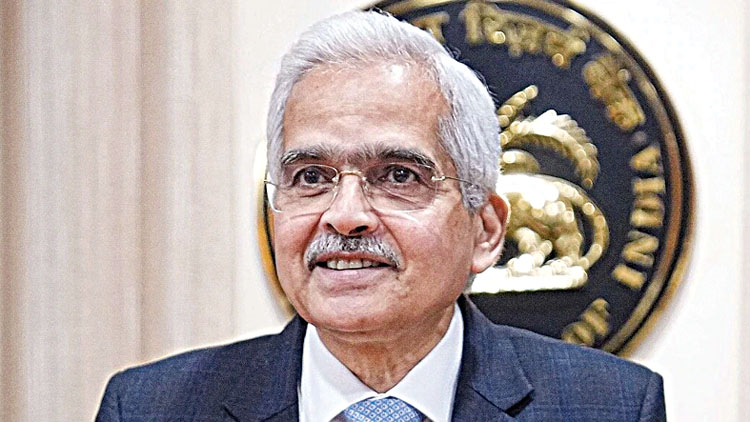

New Delhi, Jun 20 (FN Bureau) The Reserve Bank of India today exuded confidence in India’s financial sector saying it is in a much “stronger position” due to robust capital adequacy, low levels of non-performing assets and healthy balance sheets of banks and other non-banking financial corporations (NBFCs). “All stakeholders in India, namely, the Reserve Bank, the Banks and NBFCs, and the government have made tangible efforts in this direction… I would like to compliment the banks and other financial sector entities for such a stellar performance. There is, however, no room for complacency. We must keep constant vigil and continue to take proactive measures to sustain this progress,” RBI Governor Shaktikanta Das said addressing a seminar in Mumbai.

Keeping the Financial System Resilient, Future Ready and Crisis Resistant – theme of the seminar is extremely important in the current time. In today’s environment which is characterised by turbulent global spillovers and uncertainties, it is important for the financial sector to follow an adaptive and forward-looking approach to navigate amidst the emerging challenges. This would entail strengthening governance and risk management practices; employing sustainable business models; and embracing technological advances and using them to our advantage, Das said adding on its part, the Reserve Bank will continue to fine tune the regulatory architecture and the supervisory rigour, as may be required, to promote long term resilience and stability of the financial system. Das was inaugurating the second edition of the global conference on financial resilience organised by the College of Supervisors (CoS) of the Reserve Bank of India. The first edition of the conference was held last year. Elaborating on it, the Governor said “strong governance” is at the core of resilience, especially in the financial sector.

It is in fact the bedrock for informed and strategic decisions that align with long-term goals and risk management principles. In this context, he highlighted three major imperatives. First, effective governance entails establishing clear roles and responsibilities for the Board of Directors and the executive management. Both of them should possess necessary expertise and independence to take the right decisions and to effectively exercise appropriate oversight on operations. Second, he said, robust governance also involves implementing comprehensive internal controls and strong assurance functions, namely, risk management, internal audit and compliance. Internal controls should be designed to detect and mitigate potential risks before they escalate into significant issues. Regular “internal and external audits” play a critical role in this process as they provide independent assessments of the organisation’s financial health. They also facilitate genuine compliance with regulatory requirements. Perfunctory compliance with regulations would actually be self-defeating.

“I am happy to note that at the systemic level, there has been significant improvement in compliance culture in our financial system,” he added. The Reserve Bank is bilaterally engaged with the “outlier” entities wherever it notices deficiencies. The heads of risk management, internal audit and compliance functions are the conscience keepers of a financial institution. They should have the necessary seniority and independence within the organisation. These verticals in a Bank or NBFC play a critical role in identifying the gaps and weaknesses, if any, in their organisations and help in managing risks and safeguarding the institution and its reputation. The third point is the importance of ethics in governance which involves compliance with laws and regulations, both in letter and spirit; pursuit of sustainable business practices; and avoidance of mindless pursuit of bottom lines, Das said. He also talked about Business Models and Leveraging technology while managing such risks. Lastly he focused on “fine tuning” the regulatory framework and supervisory rigour to mitigate any risk. He said as risks evolve and new challenges emerge, the Reserve Bank as a regulator and supervisor constantly focuses on being vigilant, adaptive and proactive with regard to the regulatory frameworks and supervisory systems to safeguard the stability of the financial system.