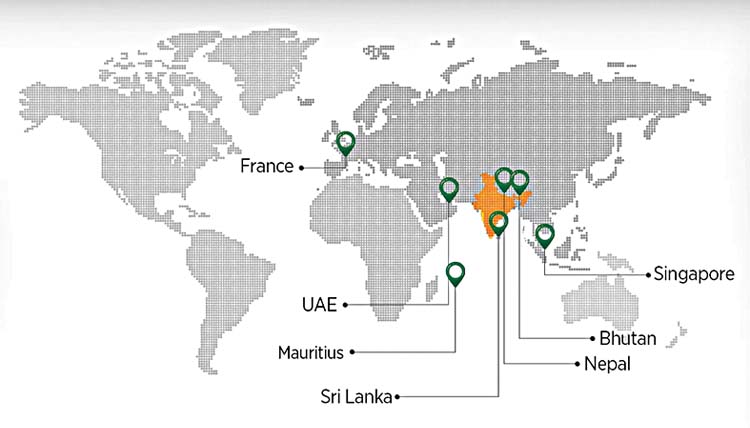

New Delhi, Feb 13 (FN Agency) Payments through India’s Unified Payments Interface (UPI) will now be accepted in seven countries after its launch in Sri Lanka and Mauritius on Monday. After the announcement, MyGovIndia, a citizen engagement platform of the Government of India, shared a world map, highlighting the countries where Indians can use UPI to make payments. France, UAE, Mauritius, Sri Lanka, Singapore, Bhutan, and Nepal are the countries that accept UPI payments, according to the government. ‘’UPI goes Global! India’s Unified Payments Interface goes International with launches in Sri Lanka and Mauritius! An instant, one-stop payment interface showcases ‘Make in India, Make for the World,’’ the tweet read.

India has been proactive in extending the reach of UPI globally. Last year, India also showcased the UPI system at the G20 meetings, enabling the delegates to experience real-time transactions over the phone. On Monday, UPI services were rolled out in Sri Lanka and Mauritius, with Prime Minister Narendra Modi describing it as linking historic ties with modern digital technology. In his remarks, PM Modi hoped the new fintech services would help the two nations and said the UPI is implementing “new responsibilities of uniting partners with India”.Before that, the payment system was formally launched at the Eiffel Tower in Paris, on February 2.

Notably, Bhutan was the first country to enable UPI transactions through the BHIM app. The UPI digital payment app was virtually launched on July 13, 2021, by Finance Minister Nirmala Sitharaman and her Bhutanese counterpart Lyonpo Namgay Tshering. Last year, a report suggested that Japan might also join India’s UPI payment system and promote cooperation on the digital identity system. Developed by the National Payments Corporation of India (NPCI), UPI is an instant real-time payment system to facilitate inter-bank transactions through mobile phones. It powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing, and merchant payments into one hood.