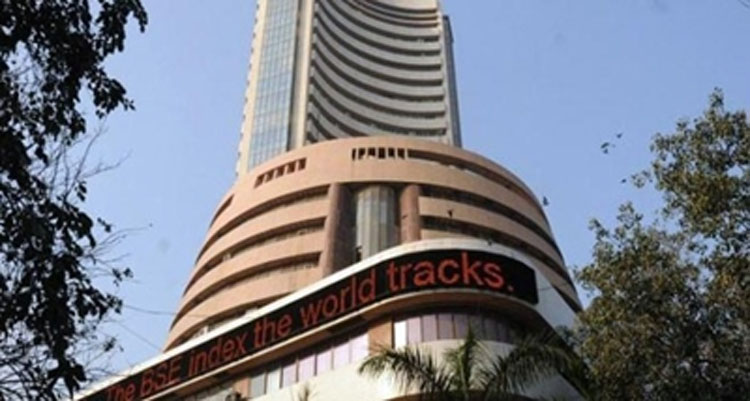

Mumbai, Jan 9 (Agency) Although delayed, Joe Biden’s confirmation as the next US president on Thursday led to a global rally which also lifted sentiment on Dalal Street on Friday. As a result, the sensex soared 689 points to close at a new life high at 48,783 points, with Infosys, TCS and RIL leading the charge. In intra-day trade, the sensex touched a new all-time high at 48,854 points. The day’s rally was supported by strong foreign fund inflow with the net buying at Rs 6,030 crore, BSE data showed.

On the NSE too, the nifty hit an all-time high at 14,367 and closed 210 points higher at 14,347, also an all-time closing high. So far this week, the sensex has gained nearly 2% while the Nifty is up 2.3%. This also took the current month’s net inflow to past the Rs 10,000 crore mark. Friday’s gains also made investors richer by Rs 2.5 lakh crore with BSE’s market capitalisation now at Rs 195.6 lakh crore.

The good news for the street is that unlike in the earlier months of the rally that started in late March, there are indications it’s lifting mid and smallcap stocks also. According to Rusmik Oza, EVP & head of fundamental research at Kotak Securities, the broader indices have performed even better than the benchmark indices: So far this week, the nifty midcap 100 index has gained 5.2% while the smallcap index on BSE is up 2.7%. “On the back of rising metal prices and of very good Q3 earnings expectations the BSE Metal Index rose by 9% this week. Other sectors that delivered healthy returns this week are telecom (up 5.9%), utilities (up 5%) and IT services (up 5.6%),” he said.