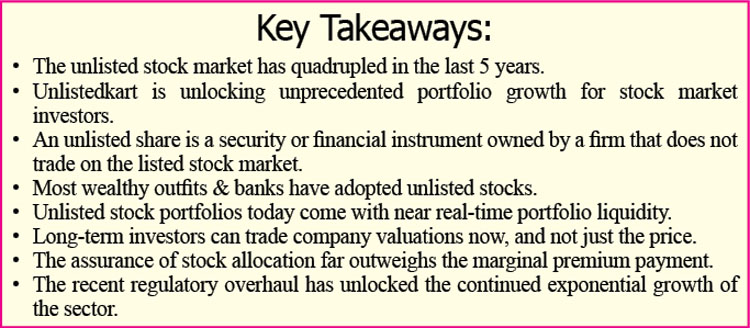

Unlisted shares today come with massive opportunities for growth and portfolio exposure as the market has been exponentially growing in the past 5 years, and has more than quadrupled in size. As Economic Times reports, many unlisted stocks doubled investors’ money in 2019 alone. 2020 saw the trend continue in full force with certain stocks “defying gravity”, such as Reliance Retail unlisted shares clocking 300% returns in 10 months. Unlistedkart has been on top of such market movements, unlocking the next avenue of portfolio growth for investors. Driven by a perfect amalgamation of primary market analysis, economic data, monitoring of venture capital deals, and unlisted equity, Unlistedkart spots the most promising private equity players for their investors.

What Are Unlisted Stocks

Unlisted shares are those companies that do not issue securities on a stock exchange, but instead directly contract with investors. In the Indian markets, investors are free to invest directly in the company by privately trading in the stocks instead of their public trading post IPOs.

Why Unlisted Shares Are The Driver For Portfolio Growth Today

One of the primary reasons that have driven this unprecedented growth; is the institutionalization of the assets. In the past, Unlisted shares as an asset class have been the subject of debates about their formal status. But their recent adoption by most wealth management companies & banks has put all doubts to rest.

Other significant reasons include:

• Unlisted Shares provide effective avenues of diversification.

• They offer stability in terms of long-term returns.

• Lucrative post-IPO returns.

• Near real-time portfolio liquidity.

All this and more are giving long-term investors enough fodder to break the traditional norms of investing in unlisted stocks with the only objective of seeing them go public. Traditionally, any deviation from this plan would have clocked a notional loss in the books. Krishna Raghavan, CEO of Unlistedkart, explains – “Today, the ground reality in the unlisted marketplace is quite different. You will find more than 300 brokers in India who can provide instant liquidity to unlisted stocks to the tune of a few crores. This addressal of the biggest roadblock to mass adoption, unlisted stocks are now easily accessible to everyday investors.” Long-term investors can go back to the roots of investing, conduct a fundamental analysis of companies, and trade their valuation, not just the price.

Unlisted Stocks Vs. Listed Stocks: Performance Comparison

Although the listed market is significantly larger than its unlisted counterpart, a keen eye can find one fundamental issue if it’s looking for it. Although the inherent presence of both investors and traders in the listed stock market provides more freedom of mentality play, the pandemic exposed a serious chunk in this armor. When panic selling hit the listed market in 2020, it took a hit by about 50% within a few months. However, the unlisted market space managed to curb the crash’s impact at 25-30% in the same period. This is an outperformance of close to 100%, making the unlisted stock market a theoretically “safer” bet than the listed market (if done right, of course). The reason is simple. Unlisted stocks only attract long-term investors, weeding out the traders. This is due to the very nature of the market in terms of movement, growth, and even regulation. Thus, it shields this market from any major panic selling.

Why Pay Marginal Premiums

For a long-term investor, the assurance of stock allocation far outweighs the marginal premium payment. If one is not looking to make a quick buck, they would instead want to add the target stock to their portfolio instead of missing out on the IPO. The risk of missing out on the IPO is far higher than paying a nominal amount as a premium. As opposed to today’s scenario where brokerage firms lean towards the top IPO picks, unlisted stock investments mean that one can find stocks with massive potential at dirt cheap prices if they time the market right. Moreover, by getting in early, one can clock hefty returns from stocks that typically gain traction after listing on the stock exchange.

Regulatory Help: The Final Blessing

The recent regulatory overhaul of the Unlisted Stock market space from RBI and SEBI has been a true blessing that unlocks the continued exponential growth of the sector. After they get listed, Unlisted stocks’ lock-in period has been reduced from 12 months to 6 months by SEBI. This means that investors can look forward to portfolio reallocation not long after successful IPOs, further reducing the risk of illiquidity. These significant events prove that regulatory authorities are extending their support to the sector and reducing the red tape around unlisted stocks. “This offers significant food for thought for the validity and formal adoption of this market, making it a viable (or even a better) alternative to the Listed market,” explains Krishna.

About Unlistedkart:

Unlistedkart LLP is a research-driven, market-making platform focused on the secondary market for late-stage/Pre-IPO/unlisted companies. It enables HNIs, wealth managers and other investors to invest early into the companies they believe in and provide much-needed liquidity to founders/ESOP holders to meet their vision.