The International Energy Agency’s (IEA’s) assessment of 2020 trends and 2021 forecasts, contained in its Dec. 14–released Electricity Market Report (EMR2020), warns of lax electricity demand in all major economies over the next year, with the notable exception of China, accompanied by a general plummet in wholesale power prices. The projection is based on the IEA’s “Stated Policies Scenario” (STEPS), which considers stated ambitions, including energy components of announced stimulus packages and climate goals, but which does not consider the recent surge in net-zero emissions targets, which the IEA incorporates in its legacy report for the first time under a “Net Zero Emissions by 2050 case” (NZE2050).

Global Electricity Demand Hinges on Pandemic Recovery

Over the past 15 years, electricity demand has almost stagnated in developed economies despite economic growth, and, in total, 93% of worldwide net growth in power demand originated in emerging and developing economies—58% in China alone. In 2021, after a sluggish year owing to the pandemic, demand could surge 3% to levels even higher than 2019, the EMR2020 suggests. However, two-thirds of additional demand is centered in the Asia Pacific region—mostly in China and India, but also in Southeast Asia.

Solar Is Generation’s New King

Despite the pandemic, net additions of renewable capacity reached a new record of 200 GW in 2020, and total capacity will surge to about 218 GW in 2021, growth that is driven by projects delayed by lockdowns and lapses in investment. In 2025, renewables are expected to overtake coal as the primary means of producing global electricity, the WEO2020 suggests. “In particular, solar PV is now the cheapest source of electricity in most countries and it has been the most-built power technology over the past three years,” noted IEA analyst Yasmine Arsalane. “We are definitely entering a new era and solar PV is becoming the new king.”

Coal, Nuclear, and Gas Face a Squeeze

Outlooks for coal, nuclear, gas, and even oil, are notable owing to stiff competition they face from renewables. About 13 GW of new nuclear are set to begin operation in 2021—and many units are advanced reactors. China is set to begin operations at Shidawowan, a high-temperature reactor; Fuqing 6, the first Hualong One design; and two other ACPR-1000s. India is targeting operation of its Bhavini, its first fast reactor, as well as a domestically designed 700-MW heavy-water reactor at Kakrapar. Meanwhile, Argentina is expected to begin running the 29-MW Carem, a small modular reactor; the United Arab Emirates (UAE) is scheduled to put Barakah 2 online; Finland was scheduled to finally commission Olkiluoto 3 (though a recent update suggests the plant will likely start operations in March 2022); and Southern Co. plans to begin operations at Vogtle 3. Other reactors include Ostrovets 2 in Belarus, an APR1400 in South Korea, and an ACP1000 in Pakistan. The U.S., however, is set to retire 5.5 GW of nuclear capacity, and three of the remaining six units in Germany are slated to go offline before the country fully phases out nuclear in 2022.

Flexibility Is Now a Cornerstone of Electricity Security

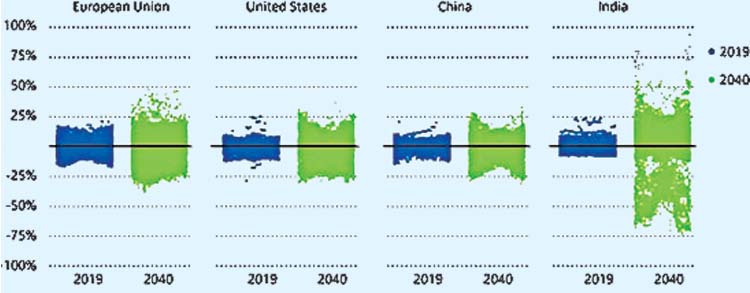

Owing to shifting power profiles—mainly an increase in variable capacity—wavering demand, and pandemic-related fuel supply disruptions, 2020 showed how important flexibility is and will be to electricity security. “One point of consistency across all WEO2020 scenarios is that flexibility needs are set to rise,” noted IEA analyst Tim Goodson. In the STEPS, flexibility needs are set to double globally out to 2040.

Market Forces Are a Wildcard

While the IEA has noted a general decline in wholesale power prices since 2019, the trend accelerated in 2020, owing partly to a COVID-driven fall in spot natural gas prices of between 20% and 50%, and a decline in power demand. The decline was especially prominent in Nordic countries.

Low-Carbon Policies, Ambitions Are on the Rise

The EMR2020 highlights a dramatic increase in national policy objectives, alongside local power market structures, fuel taxes, and efficiency and renewable support measures to enable decarbonization of the power sector. Carbon pricing, which introduces a price signal for the cost of carbon emissions, has been implemented in several regions to provide investment signals and sway electricity dispatch merit orders. In 2021, joining 31 regional emissions trading systems (ETSs), China will start a national ETS to initially cover power and heat generation from coal and gas plants. “When operational it will be by far the world’s largest emissions trading system, alone covering more than 14% of global CO 2 emissions from fossil-fuel combustion,” the IEA noted.

Oil’s Notable Comeback

Oil, which still accounts for about 3% of global generation, in 2020 benefited from the OPEC+ agreement, which put significant pressure on associated gas production for a number of OPEC producers in the Middle East. In Kuwait, owing to reduced gas burn for power and desalination, the power sector’s use of crude oil surged 11% in the first nine months. Saudi Arabia also increased direct crude and heavy fuel oil burning, as did the UAE, Iraq, and Iran to meet record-high peak summer demand. Elsewhere in the world, coal and gas competed fiercely for market share, according to the EMR2020, with gas gaining due to price drops in the U.S. and Europe. “However, the sharp recovery in gas prices since the beginning of June has started to erode the competitive position of gas-fired power plants since September,” the report notes.

Sectoral Coupling Poised to Reshape Power

In a boost to flexibility efforts, global utility-scale battery storage capacity is set for a 20-fold increase between 2019 and 2030, with 130 GW of installed batteries globally projected in the STEPS by 2030, the WEO2020 says. Global potential to tap into demand-side response, enabled by digitalization and automation, is also expected to increase by another 1,500 TWh, mainly in the buildings sector, but also in the residential and transportation sectors.